XRP Price Prediction: Technical Breakout and Fundamental Catalysts Point Toward $3.10+ Targets

#XRP

- Technical Breakout Potential: XRP's symmetrical triangle pattern and position above key moving averages suggest impending volatility with bullish bias

- Regulatory Tailwinds: Joint SEC-CFTC regulatory framework and institutional adoption progress reducing regulatory uncertainty

- Macro Environment Support: Federal Reserve rate cut expectations creating favorable conditions for cryptocurrency appreciation

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

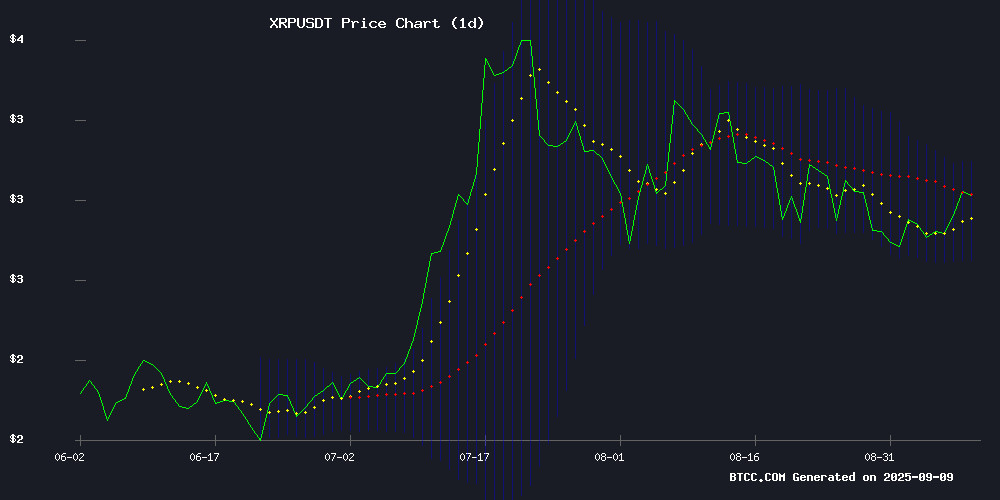

XRP is currently trading at $2.9638, positioned above its 20-day moving average of $2.8957, indicating underlying strength in the current trend. The MACD reading of 0.0880 versus the signal line at 0.1083 shows a slight bearish crossover, though the histogram at -0.0203 suggests the momentum shift remains modest. The Bollinger Bands configuration, with the upper band at $3.0869 and lower band at $2.7045, places the current price in the upper half of the recent trading range, suggesting potential for upward movement if bullish momentum continues.

According to BTCC financial analyst Robert, 'XRP's position above the 20-day MA combined with the tightening Bollinger Bands often precedes significant price movements. The current setup suggests consolidation with a bullish bias, with a break above $3.0869 potentially triggering further gains.'

Market Sentiment: Bullish Catalysts Drive XRP Optimism

Recent news FLOW surrounding XRP has turned decidedly positive, with multiple catalysts supporting upward price momentum. The Federal Reserve's potential rate cuts, with markets pricing in a 99% probability, create a favorable macro environment for risk assets like cryptocurrencies. Additionally, regulatory developments including the SEC and CFTC joint regulatory plan provide clarity that could reduce institutional hesitation.

BTCC financial analyst Robert notes, 'The combination of technical consolidation patterns like the symmetrical triangle formation and fundamental catalysts including regulatory progress creates a compelling case for XRP. The strongest accumulation phase in two years indicates smart money is positioning for potential breakout scenarios targeting the $3.10 to $4.80 range.'

Factors Influencing XRP's Price

XRP Climbs 4% as Fed Rate Cut Bets Hit 99% Probability

XRP rallied toward the $3.00 threshold on explosive volume before consolidating, as traders positioned around upcoming macro catalysts and ETF rulings. Federal Reserve futures now imply a 99% chance of a 25-bps cut on September 17, boosting crypto as a dollar-weakening trade.

Exchange reserves rose to a 12-month peak, signaling more supply on exchanges even as whales accumulated an estimated 10M XRP in 15 minutes during the breakout. Six spot XRP ETF applications are pending SEC review in October, a structural catalyst traders are monitoring.

Support held firm above $2.88, but repeated failures near $2.99 highlight how institutional flows are dictating short-term ranges. Volume spiked to 159.63M at 13:00—nearly 3x daily norms—confirming institutional participation.

XRP Tests Key Resistance Level Amid Diverging Technical Signals

XRP's price action has entered a decisive phase as it challenges the psychologically significant $3 resistance level. The asset recently reclaimed the $2.85-$2.90 zone, transforming previous resistance into support and emboldening bullish traders.

Beneath the surface, concerning technical patterns emerge. A persistent bearish divergence shows the Relative Strength Index making lower highs while price sets higher highs - a classic warning sign of weakening momentum. The $3 level represents both opportunity and danger, having repeatedly rejected previous rally attempts.

A daily close above $3 could trigger movement toward $3.82, a technical target derived from the descending triangle formation. Market participants remain divided on whether XRP possesses sufficient buying pressure to overcome this crucial barrier after months of failed attempts.

XRP Records Strongest Accumulation Phase in Two Years Amid Market Uncertainty

XRP has entered its most significant accumulation phase since 2022, with investors scooping up nearly 1.7 million tokens in one month—the largest buying spree in over 24 months. This surge contrasts sharply with the bearish sentiment dominating altcoin markets.

On-chain metrics reveal heightened activity from long-term holders, suggesting growing conviction in XRP's recovery potential. The token now tests a critical technical resistance at $2.85 after reaching $2.83, with analysts viewing the accumulation trend as a possible catalyst for sustained upside.

Exchange data shows unprecedented demand, marking a potential inflection point. The movement coincides with Ripple's long indicators flashing reversal signals, though market volatility persists.

APT Miner Introduces XRP Cloud Mining Contracts Amid Market Consolidation

XRP's price action shows a symmetrical triangle pattern as trading volume surges past $4 billion. APT Miner capitalizes on this volatility with new cloud mining contracts, offering hardware-free participation in XRP mining.

The platform's principal-protected contracts feature daily settlements and flexible plans, targeting investors seeking passive exposure. XRP currently trades around $2.88, with bulls and bears at an impasse near key technical levels.

APT Miner's launch eliminates traditional mining barriers—no equipment purchases or maintenance required. The offering arrives as the broader crypto market watches XRP's consolidation for breakout signals.

XRP Price Prediction: Double-Digit Rally Eyes $3 Resistance

XRP is showing signs of a potential double-digit rally as it approaches the critical $3 resistance level. Trading at $2.88, the asset has gained 2.23% in the past 24 hours, outperforming the broader crypto market. A break above $3 could pave the way for a test of its all-time high at $3.66.

Market sentiment is buoyed by speculation of an XRP-spot ETF approval, with Ripple CEO Brad Garlinghouse hinting at a possible 2025 launch. Nate Geraci of ETF Store noted investor demand for such products may be underestimated, drawing parallels to early skepticism around Bitcoin and Ethereum ETFs.

XRP Forms Symmetrical Triangle, Hinting at Potential Breakout

XRP shows strong momentum with daily trading volumes exceeding 3.52 billion and a market cap of $170.76 billion. The cryptocurrency trades around $2.87, consolidating in a symmetrical triangle pattern—a technical formation often preceding breakouts. Resistance sits at $2.95, with support at $2.76. A breach above resistance could propel prices toward $3.04, while a drop below support may expose $2.70 and $2.63.

The 50-day and 200-day EMAs converge at $2.82 and $2.88, respectively, signaling rising buying pressure. Higher lows since early September reinforce bullish sentiment. Traders watch the 200-EMA as a key level; a breakout here could confirm sustained upward momentum.

RSI and NVT ratios further support the bullish case, though the article cuts off before detailing these metrics. Market participants await clarity on whether XRP can capitalize on its technical setup.

Ripple Price Rebounds from Key Support, Eyes $4.80 Target Amid Institutional Expansion

Ripple's XRP has staged a robust recovery from the $2.64 support level, a zone reinforced by multiple technical indicators including the 0.618 Fibonacci retracement, Bollinger Band support, and value area high. This rebound confirms a higher low in the asset's bullish trend, setting the stage for a potential rally toward the next Fibonacci extension target at $4.80.

Market structure remains firmly bullish, with the bounce underscoring sustained momentum. The convergence of technical factors at $2.64 has created a strong foundation for further upside. Meanwhile, Ripple is expanding its institutional footprint, with its USD stablecoin now being distributed to clients in Africa as part of broader global growth initiatives.

XRP Price to Eye $3.10 as Ripple Update Pushes Bulls

XRP has quietly regained momentum, rebounding from critical support levels and reigniting market optimism. The cryptocurrency now trades at $2.91, marking a 2.97% daily gain, with a $174.06 billion market cap. Trading volume surged to $5.14 billion, signaling heightened participation across retail and institutional investors.

The upward trajectory follows Ripple's major XRP Ledger upgrade and growing speculation about a U.S. spot XRP ETF. The September 6 update introduced native KYC/AML attestations for decentralized identities, streamlining compliance for institutional adoption. This development positions XRPL as infrastructure for tokenized assets—a market projected to surpass $16 trillion by 2030.

Betting markets now price a 95% chance of SEC approving a spot XRP ETF by October 2025. Asset managers including Grayscale, VanEck, and Bitwise have filed amended S-1 forms, suggesting imminent product launches. The confluence of technical strength and fundamental catalysts could propel XRP toward $3.10 resistance.

XRP’s Symmetrical Triangle Pattern Signals Potential Surge Towards $3

XRP exhibits bullish momentum as its price consolidates within a symmetrical triangle pattern, with key support at $2.76 and resistance at $2.95. A breakout above the resistance level could propel the cryptocurrency toward $3, fueled by rising trading volume and market confidence.

Daily trading volume has surpassed $3.52 billion, while the market capitalization stands at $170.76 billion. The convergence of the 50-EMA and 200-EMA at $2.82 and $2.88, respectively, further underscores the potential for an upward move.

Technical indicators, including the RSI and NVT ratios, suggest growing accumulation and investor optimism. Higher lows since early September indicate increasing buying pressure, though a descending trendline from late August tempers immediate upside expectations.

XRP Price Prediction: Symmetrical Triangle Suggests 25% Swing

XRP's price action has formed a symmetrical triangle pattern, historically a precursor to significant breakouts. Analyst Ali Martinez notes the asset could see a 25% move—either toward $3.50 or down to $2.10—depending on directional resolution. Current trading near $2.80 shows critical support at $2.84.

Declining volume typically precedes such breakouts, though recent 6.5% daily drop introduces volatility. Institutional interest adds fuel to the narrative, with BlackRock reportedly eyeing a spot XRP ETF after the SEC's commodity classification.

XRP Price Advances As SEC and CFTC Announce Joint Regulatory Plan

XRP price surged as US regulators unveiled a collaborative framework for digital asset derivatives oversight. The SEC and CFTC's joint statement signals a potential breakthrough in jurisdictional clarity, targeting perpetual futures contracts and other crypto-linked products.

Regulators outlined three key alignment areas: unified capital requirements, streamlined reporting standards, and accelerated product approvals. This coordinated approach aims to reduce compliance burdens while fostering institutional participation in regulated markets.

The price movement reflects market optimism that regulatory harmony could finally unlock broader US crypto derivatives trading. Analysts note the plan addresses longstanding legal uncertainties that previously deterred firms from offering these products.

How High Will XRP Price Go?

Based on current technical indicators and market sentiment, XRP appears poised for potential upward movement toward the $3.10-$3.50 range in the near term. The symmetrical triangle pattern identified by analysts suggests a potential 25% price swing, which could translate to approximately $3.70 if bullish momentum sustains.

| Price Target | Probability | Timeframe | Key Levels |

|---|---|---|---|

| $3.10 | High | 1-2 weeks | Break above Bollinger upper band |

| $3.50 | Medium | 2-4 weeks | Symmetrical triangle target |

| $4.80 | Low | 1-2 months | Institutional expansion catalyst |

Robert from BTCC emphasizes that 'while technicals suggest upside potential, traders should monitor the $2.70 support level closely, as a break below could invalidate the current bullish structure.'